Consistency through evolution

Over the past 100 years, Aareal Bank has consistently evolved, reaching ground-breaking milestones along the way. The institution has successfully mastered numerous crises during its long history. And that is not all. Along the way, Aareal Bank has helped many clients to overcome crisis situations – and made its own contribution towards the rebuilding of Germany after World War II by extending numerous loans.

Our recipe for success is that we always look ahead, with the right feeling for what it takes right now. We take a long-term view, with a comprehensive and client-oriented approach. We emphasise future viability and risk awareness. Discover the most important milestones of our 100-year corporate history. Find out how (and why) Aareal Bank has continuously adapted over the course of a century, building the foundations for constant innovation and development.

Milestones

An overview of the most important milestones in our 100-year history can be found here.

-

2023

Growth prospects: the next century.

Aareal Bank is entering the second century of its history with a clear prospect of sustainable, dynamic growth, and is looking to the future with confidence.

-

2020

On course for growth: the partial sale of the software subsidiary Aareon.

While coronavirus brought the world to a standstill, the software subsidiary Aareon AG looked set to achieve further growth and to expand and increase in value. The sale of a 30 per cent stake to Advent International provided fresh impetus for this.

-

2020

The Bank remains a reliable partner during the coronavirus pandemic.

The world stopped in 2020, but Aareal Bank remained firmly by the side of its clients. It also took advantage of new opportunities created by the crisis at an early stage.

-

2013

Responsibility born of conviction: first sustainability report.

The sustainable development of the economy and society is a key objective. On its 90th anniversary, Aareal Bank Group presented its first sustainability report. Today, sustainability is in its DNA.

-

2007

The Bank shows its mettle in the global financial crisis.

The financial crisis that began in 2007 shook the world and the most important asset that banks have: the trust of clients. Thanks to its responsible and risk-conscious business policy, Aareal Bank survived the turbulence largely unscathed.

-

2003

At home worldwide: global expansion.

A global player in a globalised world: In the new millennium, Aareal Bank grew into the international structured property financing specialist on three continents.

-

2001

An independent start to the new millennium: separation from DePfa.

Concentration on core expertise: After about 20 years under the umbrella of DePfa, Bau- und Bodenbank became independent again at the start of the new millennium.

-

1997

IT expertise strengthened with the establishment of BauBoden Systemhaus

A milestone on the way to Aareon AG as we know it today: On the 40th anniversary of its data centre, Bau- und Bodenbank, now Aareal Bank, spun off its IT Services division into an independent subsidiary.

-

1990

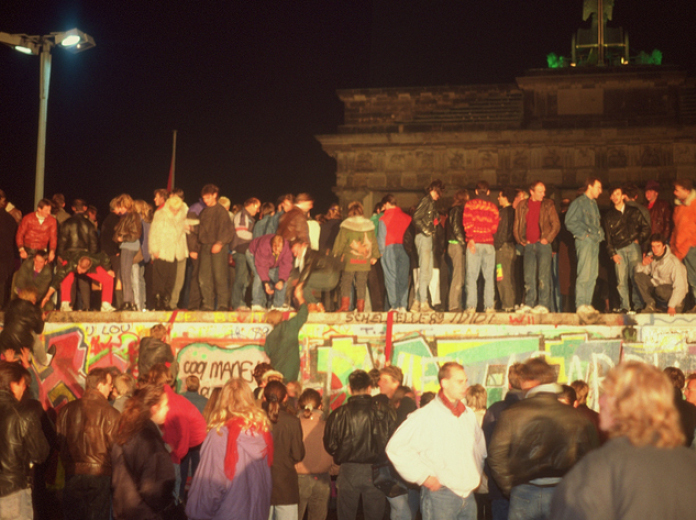

A new era: privatisation and internationalisation.

A turning point: the fall of the Iron Curtain and a surge in globalisation ushered in a new era. The privatised Deutsche Pfandbrief- und Hypothekenbank AG and its subsidiary Bau- und Bodenbank successfully exploited the limitless new possibilities.

-

1979

Success through change: takeover and realignment.

A time of upheaval: Germany's economic miracle ended with the first oil crisis in 1973. Bau- und Bodenbank, today Aareal Bank, embraced the changes and successfully restructured its business under the umbrella of Deutsche Pfandbriefanstalt.

-

1957

A pioneer of digitalisation: the first data centre.

The digitalisation of all areas of life as we know it today was at most a distant vision in 1957. With its first data centre, Deutsche Bau- und Bodenbank was ahead of its time.

-

1949

On the way to the economic miracle: a new beginning.

At the end of the Second World War, Germany was in ruins – but by 1949, there were already signs of a hopeful new beginning. In the young Federal Republic of Germany, Deutsche Bau- und Bodenbank became an important part of this.

-

1933

Adapting to the situation: the Bank in the Nazi era.

Germany's first democracy ended on 31 January 1933 when Adolf Hitler seized power. The National Socialists began a period of rule that would last for 12 years. Deutsche Bau- und Bodenbank adapted and came to an arrangement with the new totalitarian regime.

-

1923

The start of a brighter future: our foundation.

Crisis and opportunity: the early 1920s were difficult, but also brought a change for the better. The establishment of Deutsche WohnstättenBank AG, which almost 80 years later became Aareal Bank, contributed to this.