Let's shape the property sector together!

Aareal Bank Group is an established partner for the property industry. We are continuously refining our service portfolio so as to provide clients with compelling solutions – and are always on the lookout for fresh ideas and innovative approaches that are in line with our strategy.

Company founders are a very good source of such innovations. They have the courage and creativity to energise new and existing business models. This is why we want to collaborate with them, and why we have pooled our involvement with them in our Group-wide Start-Up Programme.

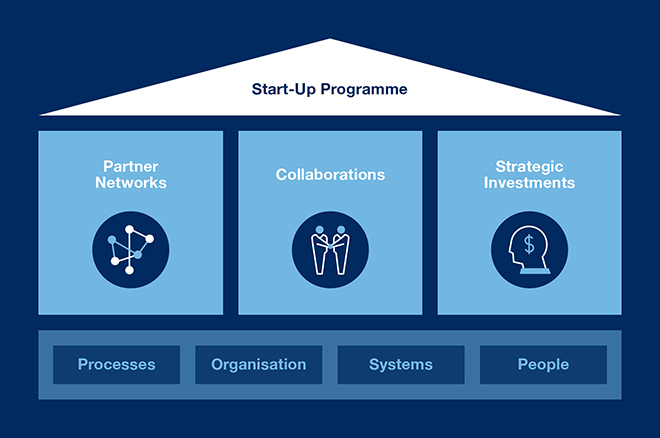

Network, cooperate and learn from each other

Our Start-Up Programme aims to specifically promote cooperation with start-ups, allowing us to shape the future of the property industry together. We want to identify the drivers for digital development, boost our own innovative ability and expand our product portfolio in specific areas. The goal in all cases is to generate real added value for our customers. And we offer company founders more than just financial support. As our partners, they also have access to our extensive partner network and in-depth sector expertise.

One programme – three fields of activity

At Aareal Bank, we cooperate with fintechs, proptechs and other start-ups in three different ways:

1. Partner networks

Our partner networks pool support programmes to provide start-ups with financial resources, mentoring and training schemes. This allows them to focus on developing their ideas and making them ready for the market. One example: our IT subsidiary Aareon is a strategic partner for Germany's first proptech accelerator – blackprint PropTech Booster – which brings together company founders and established industry players.

Our experience with start-ups was very promising right from the start – reason enough for us to start working with Plug and Play, the world's largest start-up platform. Together with TechQuartier, Plug and Play founded the Fintech Europe innovation platform in Frankfurt in 2018, with Aareal Bank as a founding member. This has allowed us to collaborate with start-ups from the national and international financial sector, and to develop applications relevant to our clients.

2. Partnerships

Innovative ideas here, sector expertise and connectivity with existing systems there – collaboration between start-ups and Aareal Bank Group, as an established player in the property industry, makes perfect sense for both parties. And it is our clients who ultimately reap the most benefits. A few examples:

Aareon Connect

Aareal's subsidiary Aareon launched Aareon Connect at the beginning of 2023, enhancing its openness for third-party solutions. The platform pools a large number of software solutions for the property industry. Property companies can select the solutions that are relevant for them and then integrate them with their ERP system. Numerous clients and partners have already been onboarded to Aareon Connect, which has also been rolled out in the UK and the Netherlands.

bots4U

This German proptech is one of the leaders in the field of AI-driven chatbot and voicebot solutions for the property industry. Automated communications processes offer the best possible customer experience while also cutting costs. Neela, the virtual assistant, which was developed together with Aareon, helps housing enterprises to communicate efficiently and digitally with tenants. Equally, the Taara chatbot provides advice and assistance for customer on our Aareal Service Portal.

KIWI.KI

KIWI.KI, a Germany-based partner company, has developed an electronic access system with a digital administration portal, which can be used to manage access rights to all doors in a property portfolio. The system has been integrated with Aareon's ecosystem.

Klima.metrix

Berlin-based start-up Klima.metrix has developed a carbon footprint calculator that makes it easier for companies to assess the carbon emissions from their activities. Internationally recognised assessment standards permit comparability and bring transparency to the carbon-intensive property sector. The solution helps Aareal Bank calculate the carbon footprint for its property financing portfolio.

pixolus

Aareal Bank Group has partnered with pixolus, a Cologne-based mobile data capture specialist, to develop the Aareal Meter mobile meter reading app. Aareal Meter permits mobile meter data capture using smartphones, digitalizing the laborious, error-prone and non-transparent meter reading process. The solution offers tangible efficiency gains and has been adopted by a large number of companies in the utilities sector and the housing industry.

Raisin

Aareal Bank's partnership with Raisin and Deutsche Bank ZinsMarkt, which was launched in mid-2022, offers it efficient market access to retail customer deposits. What is more, the business has been expanded and Aareal Bank's fixed-income offerings are now also available on the WeltSparen investment platform.

Realxdata

This Berlin-based start-up aims to significantly improve data availability and quality in day-to-day property industry operations by ensuring modern, digital data management. Since September 2021, Berlin-based proptech Realxdata has belonged to Moody’s Analytics, a subsidiary of US rating agency Moody’s.

Rocketloop

The AI specialists Rocketloop in Frankfurt help middle-market companies and groups to launch intelligent digital products on the market. It worked together with Aareal Bank to develop a news tracker that enables specific information relevant to the Bank's financing portfolio to be sourced from the web, enriched by a range of analysis options and then used in the credit monitoring process.

3. Strategic equity investments

Munich-based proptech Wohnungshelden develops software solutions for digitalising the rental process. Its software covers all the steps in the process from property marketing through applicant and appointment management down to the signing of the contract. Aareon acquired the proptech in mid-2021, expanding Aareon Connect's suite of offerings in the digital rental space.

Aareon acquired Fixflo in May 2021. The United Kingdom's leading supplier of property repairs and maintenance management software has developed an app to manage complex repair processes. The app uses a single platform to bring together the business processes used by property managers, owners, tenants and contractors, optimising them to everyone's satisfaction. The acquisition has expanded Aareon's market position in the UK and extended its range of products for the property industry.

Aareon also acquired Arthur, which is based in London and which offers a best-in-class SaaS solution that significantly streamlines property management processes. The software brings together all the stakeholders in a tenancy in a single app, simplifying the associated management processes.

In March 2022, Aareal Bank took over payment solutions provider CollectAI. Based in Hamburg, this fintech offers an AI-driven order-to-cash platform that lets property companies collect receivables more rapidly, intelligently and sustainably. CollectAI supplements Aareal Bank Group's existing platform offering, opening up potential new markets and client groups.

At the start of 2019, Aareal Bank acquired plusForta, a market-leading provider of tenant deposit guarantees in Germany. These have become an established alternative to cash bonds and are accepted as tenant security guarantees. plusForta arranges these guarantees via the online platforms kautionsfrei.de and kautionsfuchs.de. The service is aimed at tenants of residential apartments and commercial property.

OSRE B.V. has designed a digital solutions platform that makes property sales and rentals more efficient. The added value of OSRE B.V.'s digital platform is the complete automation of transaction processes related to the property industry. From advertising through checking current and prospective tenants, down to onboarding and signing contracts – companies are able to implement transactions more quickly, more smartly and more reliably. The investment was made in April 2019.

In mid-2019, Aareal Bank invested in PropTech1 Ventures, a venture capital fund specialising in European proptech start-ups. The sector-specific fund focuses on the property industry. Our investment in PropTech1 Ventures, which is in the mid single-digit millions of euros, continues our strategic agenda of exploring relevant property sector ecosystems.

In July 2020, Aareal Bank invested in objego, a joint venture together with energy services provider ista. This proptech from Essen was founded in 2020 and offers private landlords an intelligent property management solution. The cloud-based management software provides straightforward service charge billing, financial management and digital documentation management. We sold our equity investment to ista in the summer of 2023.

Interested? Then get in touch!

Do you have ideas or possible solutions that could offer real added value to our clients from the world of property? And are you looking for an established partner to help you make your innovations a reality? If so, then please get in touch with us. We look forward to hearing from you.