Green Lending Business (ESG)

We consider our green lending products to be a core way of ensuring our business model is fit for the future. We have defined environmental sustainability criteria for commercial property based on our valuation expertise, our many years of experience, our property market knowledge and existing market standards. These form the basis for our "Green Finance Framework – Lending". In addition to compliance with minimum energy efficiency standards and the existence of certain high-quality building certificates, the requirements for Taxonomy-aligned buildings are considered a potential qualification criteria for green loans3 . This definition was developed together with internal experts with the goal of applying it for our global operations A second-party opinion by ESG rating agency Sustainalytics reviewed the framework developed in this way for the ambition, market conformity and suitability of the qualification criteria, and rated it as "credible and impactful". This independently certified framework serves as the basis for extending green loans. Both the criteria and the second-party opinion were updated in the reporting period.

As a property financer, we share our property sector clients' responsibility to help reduce the impact made by existing housing stocks on the environment. Thorough knowledge of our financing portfolio's climate impact is a precondition for taking forward-looking, goal-driven decisions. This is why we decided back in 2021 to sign the PCAF Commitment Letter and to report on the carbon emissions in the commercial real estate financing portfolio that we finance in accordance with the PCAF Standard by the end of 2024 at the latest.

Green Finance Framework - Lending

In our Green Finance Framework - Lending, we disclose the eligibility criteria for environmentally sustainable properties and define when energy-efficient renovation measures make a significant contribution to the transformation of the existing building stock towards greater energy efficiency, we provide transparency and allow our clients to make informed investment decisions. In addition, this enables us, as a provider of financing solutions in the property sector, to identify and provide green lending and to report it as such.

- Green Finance Framework - Lending

- Second-Party Opinion - Aareal Bank Green Finance Framework - Lending

- PCAF report on financed carbon emissions

Our portfolio of property loans with stable values

Aareal Bank Group finances commercial properties – and in particular office buildings, hotels, shopping centres, and logistics and residential properties – rather than industrial plant and projects that are controversial from a sustainability perspective or properties that are contentious for other reasons. We focus on financing existing buildings (investment financing).

Active portfolio management makes it possible for us to optimally allocate equity to the most attractive products and regions from a risk /return perspective, within the scope of our three-continent strategy. By complying with maximum allocations to individual countries and ensuring a variety of property types within our portfolio, we ensure a high level of diversification and avoid concentration risk, something that we achieve not only by managing our new business but also via our active syndication services.

The use of specific quantitative and qualitative criteria and a high level of risk sensitivity both contribute to the quality of our portfolio. We combine a keen eye for opportunities and risks with local market expertise and in-depth sector knowledge. This enables us to produce end- to-end assessments of properties or loans.

Our sustainability criteria in business planning and property valuation

Active portfolio management makes it possible for us to optimally allocate equity to the most attractive products and regions from a risk /return perspective, within the scope of our three-continent strategy. Thanks to our active portfolio management regarding countries, products and types of property, we guarantee a high level of diversification while avoiding risk concentration in our portfolio. Material portfolio management instruments are the management of new business and active syndication services.

Sustainability as a criterion for financing

Our fundamental assessment of the business environment in countries in which we are, or aim to be, active includes both economic aspects such as changes in gross domestic product, unemployment rates and interest rate trends or property market developments but also other factors such as legal certainty, market transparency and levels of corruption in the country concerned.

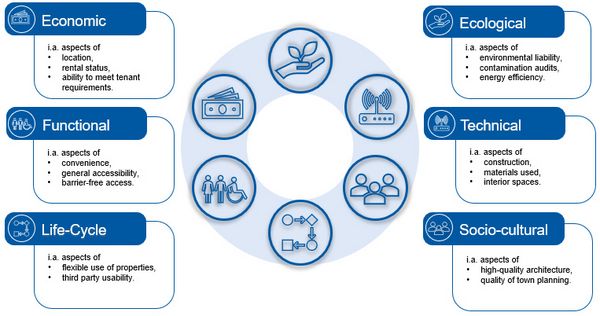

We take the following sustainability criteria into account during property valuations performed in association with lending decisions:

- Economic quality, e. g. the property’s location and rental status, the ability to meet tenant requirements and the economic efficiency of the floor plans

- Technical quality, e. g. issues relating to the building’s construction, the materials used, fire protection, thermal insulation and soundproofing, fittings and fixtures and the quality of the interior spaces (measured in terms of their thermal, acoustic and visual comfort)

- Functional quality, e. g. the convenience of a property’s location and its transportation links, general accessibility and barrier-free access

- Life-cycle quality, e. g. as demonstrated by opportunities for flexible use of properties, the ability to relet them, thirdparty usability and appropriate expenditure on value preservation measures

- Sociocultural quality, e. g. high-quality architecture, the quality of town planning and potential tenants

- Ecological quality, e. g. as expressed by environmental liability and contamination audits, and energy efficiency

Regular reappraisals of property valuations in the form of valuation reports allow changes in the criteria shown in the graphic to be identified:

Our far-sighted, risk-aware lending policy and efficient loan approval process

In the area of commercial property financing, our main focus is on investment financing, i.e. on financing completed buildings. The properties are usually secured by senior liens, can serve as cover assets and have moderate loan-to-value ratios. We satisfy ourselves for each and every loan of the enduring quality of the properties that we finance.

In the lending business, Aareal Bank Group's organisational structure and business processes are consistently geared towards Group-wide effective and professional risk management. This includes comprehensive compliance with supervisory requirements. Our consistently low credit risk indicator is proof of the contribution that Aareal Bank Group makes to the stability of the financial market, especially in the area of commercial property finance.

Financing properties and portfolios entails more than just granting loans. With markets changing more and more rapidly, our clients’ success depends critically on whether they can gain a lead in the markets in which they operate. Our structuring skills – i.e. our ability to implement customer wishes and expectations – in the financing business and our efficient loan approval process aim to ensure our clients have this advantage.